THANK YOU!

Every fall, thousands of promising young scholars start their Ohio University journey with a Bobcat rite of passage, entering OHIO’s historic College Green through Alumni Gateway. Every spring, thousands of graduates celebrate the pinnacle of that journey by departing through Alumni Gateway.

Behind every step of their journeys is the generosity of donors like you.

Your philanthropy in service to an Ohio University education fuels our mission of intellectual and personal development, producing lifelong learners and engaged citizens.

Details on the endowment(s) you have established within The Ohio University Foundation—as well as overall endowment performance—are enclosed.

Thank you for your unwavering commitment to transforming lives, to making excellence possible and to Ohio University.

With gratitude,

Jacquelin R. Weber, BSS ’96

Executive Director, Donor Engagement

January 1, 2018–December 31, 2018

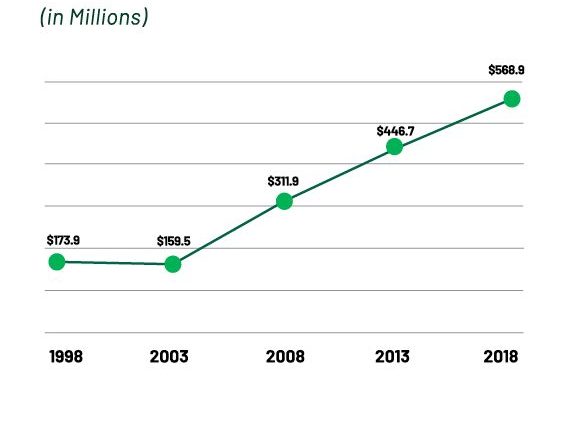

The endowments that support Ohio University have grown by almost $395 million in the past 20 years. These endowed funds provide essential support for the University’s academic mission through scholarships for students, support for faculty research and creative activity, and resources for programs, partnerships, technology, and facilities.

The endowments that support Ohio University have grown by almost $395 million in the past 20 years. These endowed funds provide essential support for the University’s academic mission through scholarships for students, support for faculty research and creative activity, and resources for programs, partnerships, technology, and facilities.

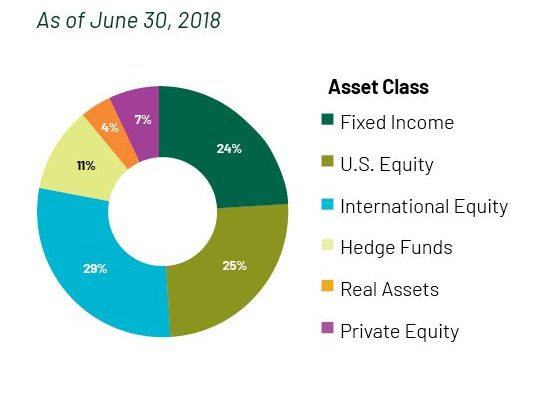

The endowment portfolio is professionally managed, with the long-term objective of producing real growth in excess of the spending policy and inflation. The endowment is broadly diversified into equities, fixed income and alternative investments, including commodities, private equity and hedge funds, with a 75% allocation to equity-oriented investments and 25% to fixed income-oriented investments. This allocation provides the opportunity for high risk-adjusted returns.

The endowment portfolio is professionally managed, with the long-term objective of producing real growth in excess of the spending policy and inflation. The endowment is broadly diversified into equities, fixed income and alternative investments, including commodities, private equity and hedge funds, with a 75% allocation to equity-oriented investments and 25% to fixed income-oriented investments. This allocation provides the opportunity for high risk-adjusted returns.

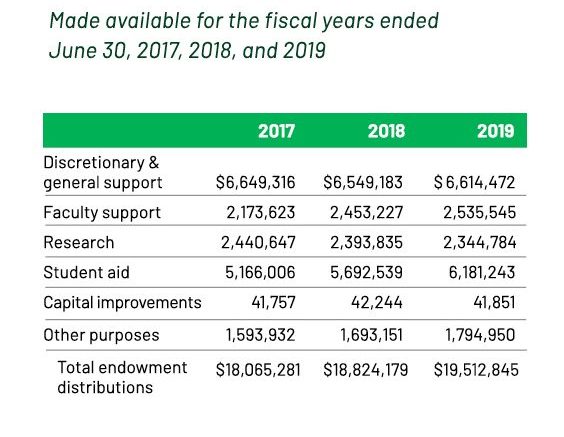

Endowment earnings are authorized for expenditure based on the endowment’s average market value for the trailing 36 months. For fiscal years 2017, 2018 and 2019, the spending rate was 4% for endowed accounts whose market value exceeded the historic gift value. Occasionally, due to a downturn in the investment market, an account’s market value may temporarily fall below its historic value. When this occurs, the endowed account is “underwater.” The spending rate for underwater endowments is 1%.

Endowment earnings are authorized for expenditure based on the endowment’s average market value for the trailing 36 months. For fiscal years 2017, 2018 and 2019, the spending rate was 4% for endowed accounts whose market value exceeded the historic gift value. Occasionally, due to a downturn in the investment market, an account’s market value may temporarily fall below its historic value. When this occurs, the endowed account is “underwater.” The spending rate for underwater endowments is 1%.

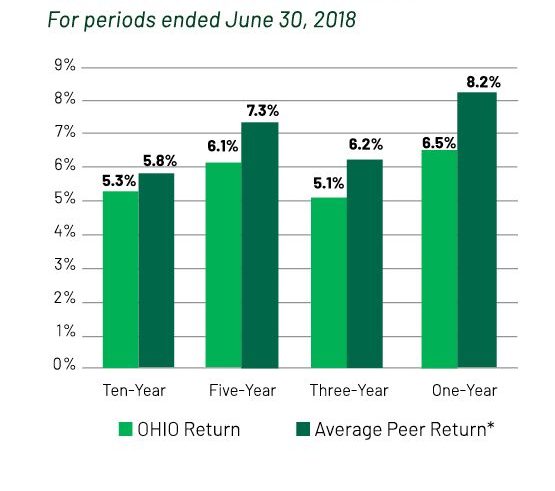

*Represents the average nominal rate of return, as reported in the 2018 National Association of College and University Business Officers (NACUBO) - TIAA Study of Endowments.

*Represents the average nominal rate of return, as reported in the 2018 National Association of College and University Business Officers (NACUBO) - TIAA Study of Endowments.